A scratch on a new car is annoying. But it is not so unpleasant when the vehicle is insured. Insurance will not protect against accidents but will help overcome them much more manageable. Now there are different types of insurance, and car insurance is one of the most popular areas with an increase in the number of car owners.

The digitalization of the insurance business is a win-win trend that helps optimize provider resources and customer experience. Mobile apps have changed the game’s rules in the car insurance sector worldwide. Insurance companies no longer rely on conventional channels such as brokers to reach their intended clients.

Therefore, building a progressive auto insurance app will benefit your business if you are an insurance firm or work with insurance providers. It is another great opportunity for you to be closer to existing customers. So, if you want to know how to design a website or app for an insurance company, read our previous article about it. But today, we will talk only about the car insurance market sphere.

How to design a Web App or Site for insurance company

If you are ready to level up your business, keep on reading, and you will know how to create a car insurance app to succeed.

Why Do You Need an App For Car Insurance Business?

A BITKOM study showed that 55 percent of German customers buy auto insurance policies online, increasing to 65 percent in the under-30 age group. Germany’s statistics are standard for all countries with a high HDI (Human Development Index), and this trend should not go unnoticed. Thus, developing an app for car insurance is an excellent prospect for a company owner.

The auto insurance sector has great potential. In countries like the UK and the US, insurers evaluate car loans and apply for insurance online. As a result, each person has access to all information related to insurance via the Internet.

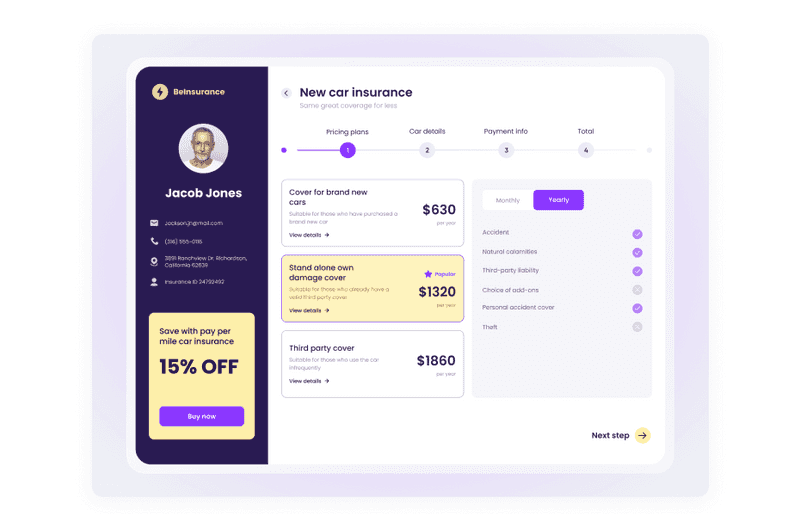

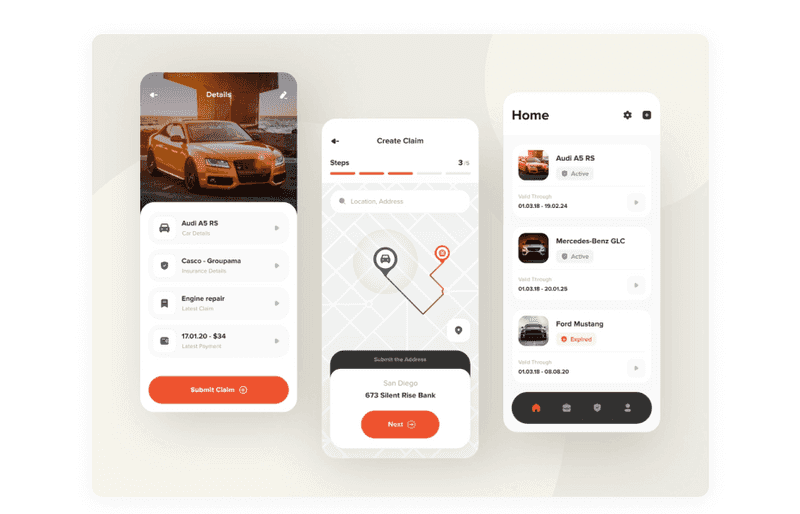

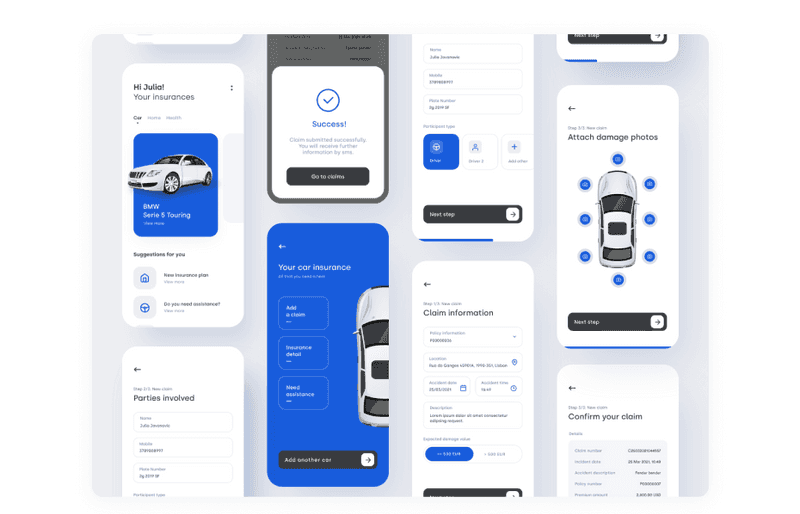

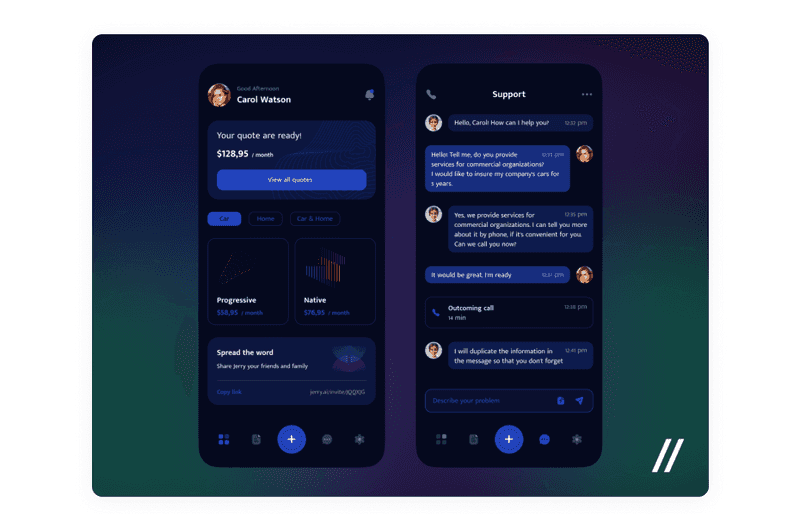

Dribbble shot by Axicube

Today, many customers are looking for faster and easier ways to apply for the insurance they need or request the processing of a claim. They can simply achieve this through auto insurance apps. As a result of developing an app like this, your users will access insurance even when they are literally on the road. But what other reasons for the demand for car insurance apps exist among users?

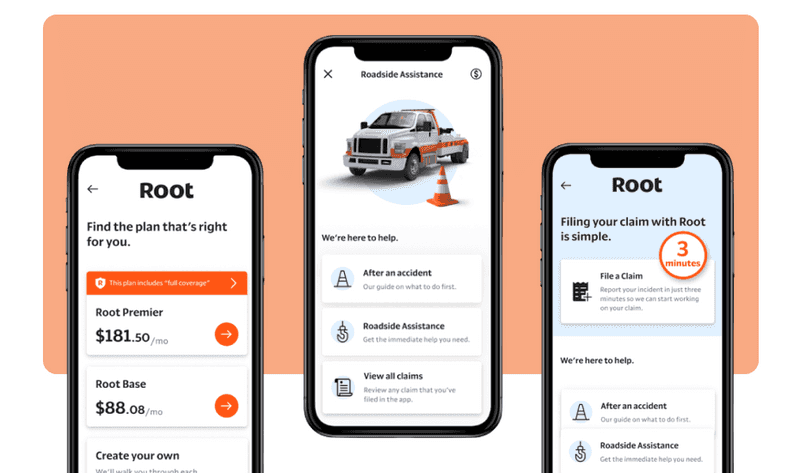

Why are Car Insurance Apps Like Root Popular?

As of 2020, over 275 million vehicles were registered on US roads. Unfortunately, there are also millions of traffic accidents each year of these millions of registered vehicles. In 2019, there were around 1.9 million fatalities, roughly five million vehicle crashes, and a little more than 70 percent only involved property damage. So while many people feel safe in their vehicles, the statistics point to the importance of car insurance, which is required by law in most cases.

Since shoppers between the ages of 20 and 35 spend about 54-66% of their time with smartphones, some companies launched car insurance apps successfully. One of the most brilliant examples is the Root car insurance app. This app evaluates users by their driving manner and offers reasonable insurance rates. Root has been featured in Forbes, Fortune, Wired, and other notable publications for its security reward strategy. In addition, the user base notes the transparency of the calculations and good support.

Auto insurance apps are accessible to users, easy to use, and quickly help in case of a traffic accident. There are main reasons why car insurance apps are on-demand:

-

Save time

With the help of automated processes in the app, the user can quickly download the necessary documents and make claims. In addition, by using their smartphones, consumers can take photos in case of an accident and send them via their mobile insurance app for claiming insurance.

-

Save users’ finances

Car insurance apps give users tips on reducing fuel consumption, improving driving efficiency (to receive insurance payments), or finding a gas station where it is cheaper to fill up.

-

Reduce driver’s tension and strain

Auto insurance applications cannot save people from car accidents, but they can minimize the risk with safe driving tips, reducing driver stress, and more.

We figured out why people like these apps and they use them. But what is the benefit of developing an app for an existing auto insurance business?

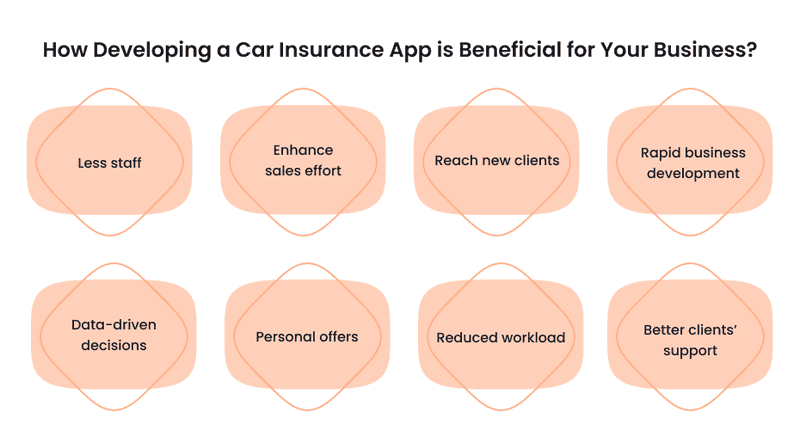

How Developing a Car Insurance App is Beneficial for Your Business?

Business digitization is on a massive scale. Now, having a business application is no longer a luxury but rather a necessity, as it provides a tremendous competitive opportunity.

So, you have a plan and a list of business goals to reach. What’s next? You may think that there are many solutions on the App Store that no one downloads. So, to not fail, you need to create an app that will give benefits to your business and will be helpful for people. Ask yourself why people need such an app and what users’ problems you can solve with it.

You need to understand the task that people face so that after downloading your application, they return to it from time to time and do not continue to call the call center.

-

Less staff

You will need fewer employees and will be able to save money on operations because the app will allow you to interact with customers more effectively.

-

Enhance sales effort

Insurance agents can use an app to stay in touch with their offices 24 hours a day. In addition, these mobile applications allow them to do their job even when they are traveling or waiting for clients. They can also get quick access to sales force automation and CRM, allowing them to manage their leads effectively.

-

Reach new clients

Developing a car insurance app opens up additional channels to attract new customers by advertising the app in various industry sources.

-

Rapid business development

Your business can grow rapidly. Users can access your services through this mobile app even if you do not have an office in their region or city.

-

Data-driven decisions

With the app, you can collect more demographic information about your customers and, based on this, make decisions that will help grow your business.

-

Personal offers

Returning to the fact that the auto insurance application helps to collect various information about customers, you can, based on this, offer them personalized offers that they cannot refuse.

-

Reduced workload

Because of the automatization of many processes, you will get rid of paperwork. Yet, the app would eliminate errors due to the human factor.

-

Better clients’ support

Developing a car insurance application, you can create interactive external channels to work with consumers 24 hours a day, seven days a week. The insurance app supports customers in every possible way. For example, an implemented chatbot can answer frequently asked questions.

Insurance apps allow insurers and businesses to use the power of mobility and online marketing to stand out in the marketplace. These apps can help you build trust with your target audience, grow your customer base, attract and retain them with personalized offers and discounts, and more by automating insurance processes. Combining these factors affects your company’s bottom line and helps you grow.

Now that we’ve covered why creating an app for your auto insurance business is a good idea, we can move on to how to do it.

How to Create a Car App

Now you are already on fire with the idea of creating an application for your insurance business. But where to start? Every digital project essentially has a close structure. We talked about this in our previous article about the design process. Read it to delve deeper into it.

How Do the Perfect Design Process Steps Look? Everything You Need to Know

Everything starts with a plan. But that sounds too vague and general. Let’s take a closer look at what it takes to plan out your auto insurance app idea carefully.

Finalize the Idea

First, research the market. List your competitors and see if they have apps. What features do these car insurance applications have? Think about what it is about their products that entice users. With the help of competitor analysis, you can also notice for yourself some design solutions that work well. Competitive analysis helps to understand the weaknesses and what to look for.

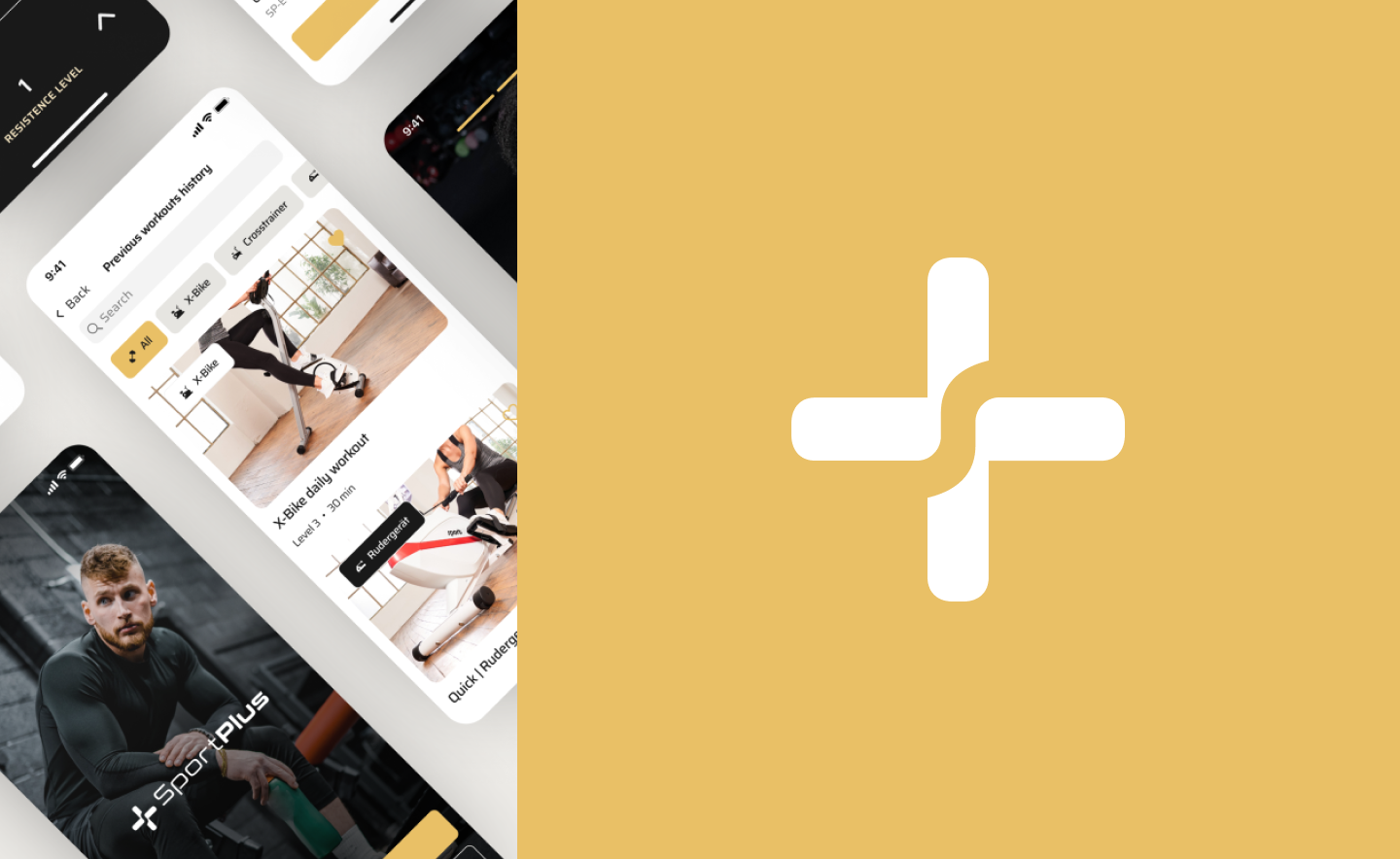

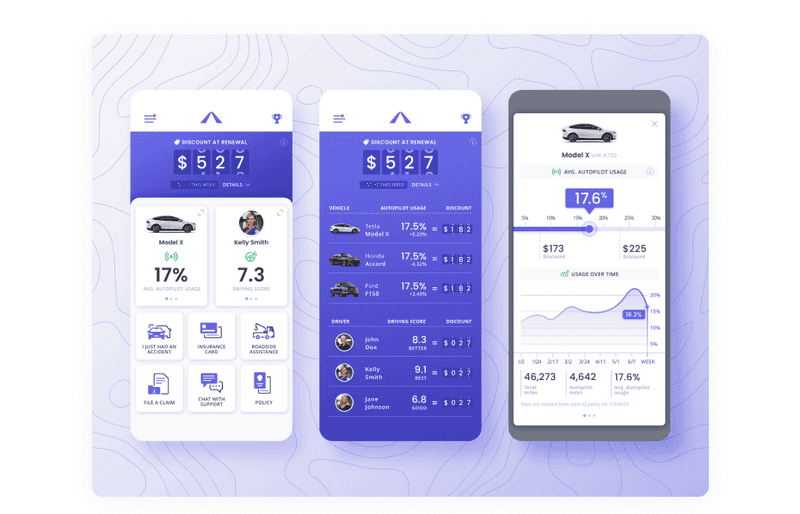

Dribbble shot by Akveo.Design

Equally important is audience research. Who will the product be created for? Is there an audience segment you would like to approach? Information about your users will also help finalize the idea and concept. List the frequent users’ requests and create an app to solve most of them. Then, think about answering their questions with your future car insurance app.

According to these results, set your goals to know where you go and think about achieving your goals. Next, write down a strategy and calculate the budget. Then, to better understand the degree of success, set the KPI. To make a progressive car insurance app, you need to think over everything.

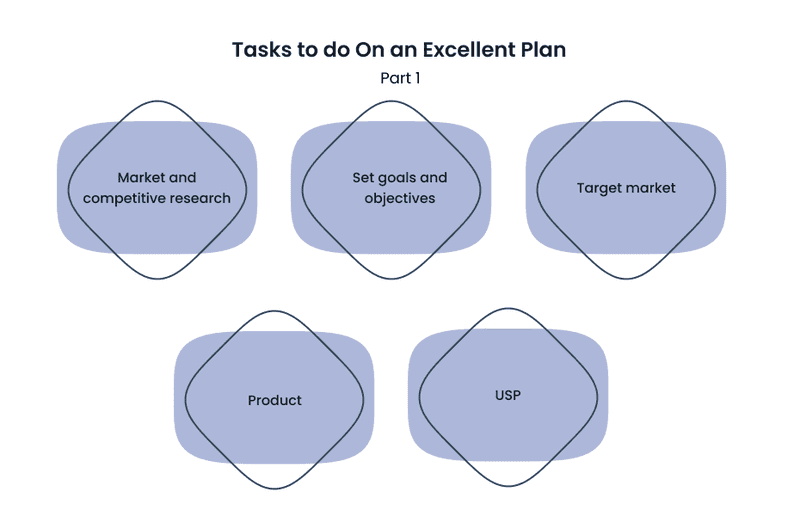

So, just to sum up, there are your tasks to do on an excellent plan:

-

Market and competitive research

Any effective plan starts with research. Market research (also known as industry research) is the process of analyzing the market and current products to help you find business opportunities and define your target audience.

If you develop a startup marketing plan, you can discover what unmet user or industry needs exist, giving you an idea of what your future car insurance app should be. If you want to create an app for a car insurance business that already exists, market research won’t be an extra.

Then, the competitors’ research goes. To find out who your competitors are, ask yourself, “What are all possible alternatives to my app that someone in my market segment would consider?” Once you have identified your competitors, you need to analyze how they perform to their target audience. It is necessary to notice essential aspects for yourself.

Dribbble shot by Marta Rodrigues

-

Set goals and objectives

A goal is a more general statement, such as “I want to increase the number of customers.” A goal, on the other hand, adds specific details to your goal, such as “I want to increase insurance sales by 10% next quarter.”

Start with your business goals and objectives, and then use them to create marketing objectives. Marketing goals support your business goals. For example, if you want to become a market leader in your industry, your goal is to increase your social media followers and increase sales by launching an auto insurance app.

-

Target market

You have a specific group of ideal prospects known as your target audience as a business. In addition, every small business marketing plan requires a particular target market.

The demographics of your customer base and the target audience of your marketing plan don’t have to match.

-

Product

Once you’ve identified your target market in your small business marketing plan, it’s time to focus on the product.

After specifying your future car insurance app’s features and details, determine how your product relates to your target market. For example, how will it solve the problems of your target audience?

-

USP (Unique Selling Proposition)

In the positioning phase, define your competitive advantage. What can you offer the market and customers? How better than your competitors? After comparing yourself to your competitors, create a unique selling proposition (USP).

Yet, analyze the goals of your customers. They have already bought insurance from you. What will make them download the application? What do they need to take this step?

-

Strategy

It’s about how you will achieve your business and marketing goals.

-

Budget

Most likely, you do not have an unlimited amount of resources. Therefore, you need to review your goals and objectives and set a budget for your marketing strategy.

In most cases, you should get a positive return on investment (ROI). Simply put, you need to make more money than you spend.

-

KPI

Before implementing the plan, you need to list key performance indicators. Key Performance Indicators (KPIs) are the metrics by which you will measure the success of your program. Like your budget, your performance metrics depend on your goal and tactics.

Let’s say your goal is to increase the number of signed insurance policies, and you plan to achieve this by launching an auto insurance application and thus increasing the flow of customers. Your KPIs are the number of insurance policies signed and the app conversion rate.

Then, after fully defining the idea of the product and its audience, it’s time to move on to the central part. Now you are ready to create an extremely converting car insurance app.

Plan MVP

Well, you’ve done a lot of surveys and identified the main goals of your application and business in general. Now the task is to understand what needs to be invested in the application so that your customers who already have an insurance policy from your company want to download your car insurance app.

With an MVP (Minimum Viable Product), you can test the market demand for your product by finding out whether the product is needed and will be used by potential users without having to invest large sums of money. Based on these findings, you can either rework the idea or develop a new concept altogether. For example, for your future car insurance app to be successful, you need to conduct user research to ensure that their product provides the solution their customers have expressed a need for.

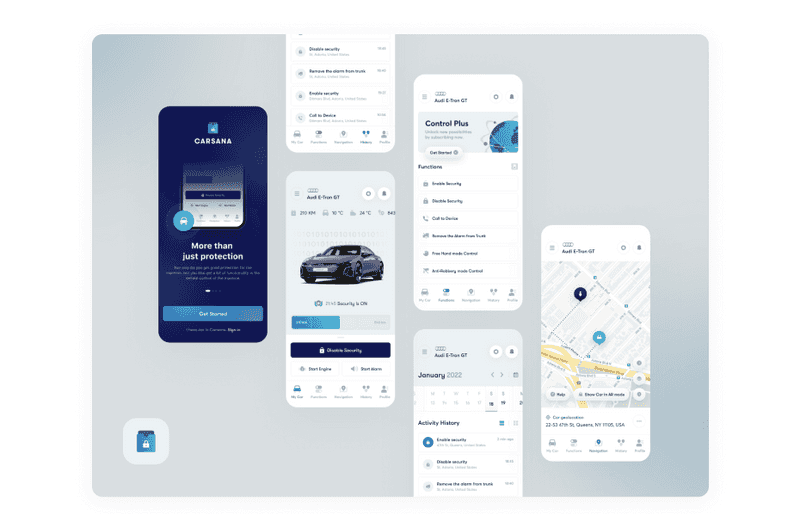

Dribbble shot by Toglas Studio

Finally, create an MVP with must-have features included to make it. You must run both an internal and an external test at the very least. Internal testing refers to the process where your development team evaluates the application as if they were the end-users. When you provide your mobile app for testing to someone unfamiliar with it, you conduct external testing.

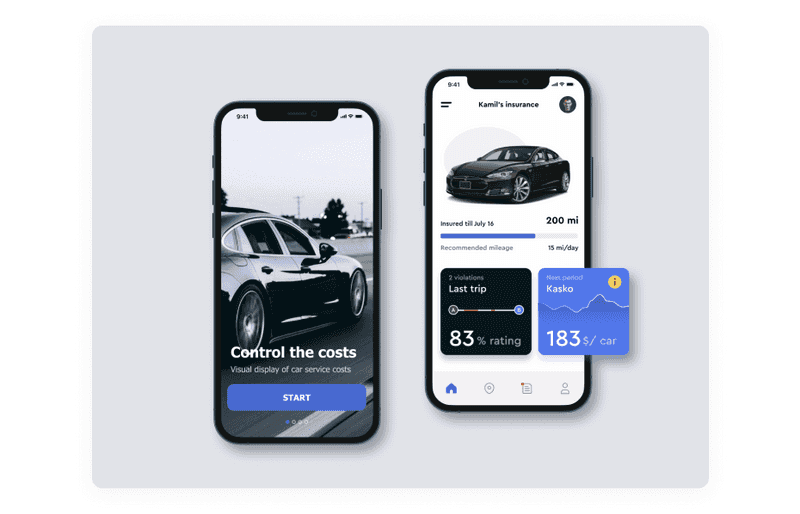

Define the User Experience and User Interface (UI/UX)

The next step in creating an app is choosing a car insurance software and platform. After that, your app will be adapted to a specific operating system. Next, you must determine if you are developing an iOS or Android app as a mobile app developer. You will need to know your audience and your budget and goals to do this. Alternatively, you can develop a hybrid app that will run on iOS and Android devices.

Before jumping directly into the design, it’s good to start the project by planning the user journey and wireframes. Thus, it will be easier to build a hierarchy in the application and understand how to place the components to make it convenient for users to use the product. In our previous article, we’ve discussed the importance of this stage in the design process. So we won’t concentrate on it today.

What is a Wireframe and Why Do You Need it in the Design Process

When working on wireframes, think about building a good UX. It matters because it helps users archive their goals in your car insurance app. According to Toptal, 88% of users will not return to an app after a bad user experience. If you want to know more about how to improve mobile user experience design and why you need to pay attention to it, read our previous article about it.

Tips and tricks on how to improve your mobile UX design

But don’t just focus on the UX part. Your auto insurance application should be not only user-friendly but also nice looking. Remember that people are attracted to beautiful things. At the same time, you should keep in mind the app’s primary function and not overdo it with an abundance of visual effects and elements.

After creating the UX and UI part of the project, it is time to move on to an equally important step to creating a product.

Test it!

After the design part of the project is finished, you need to test your prototypes to ensure that it does not contain errors. Next, make sure your car insurance app is easy to use and test your wireframes.

After testing, perhaps ways to improve your car insurance app will be identified. Then, unfortunately, you may have to go back to the wireframe or design step again. In essence, a product prototype is tested until it is polished to an acceptable state.

Dribbble shot by Josh Warren

So, now you’ve seen an overview of how to make a car insurance app. But what to include in there to make it great? A good design is not enough. Why do people use apps like these? Because of their usefulness and features that make their lives easier. Let’s find out what these are.

Must-have Features for Car Insurance Application

We talked about the MVP a little earlier and that it needs to include the main features. So what are these features for app-based car insurance?

-

Registration form

It is better to offer several registration options for user convenience, including registration by mobile phone number, email, etc. Some users may not have an insurance card ID when downloading the app. Using only insurance ID credentials to sign up for an account may not be the best decision.

Be sure to use all available mobile authentication methods, such as FaceID and TouchID, to access documents or financial data inside the app.

-

User profile

If we talk about the auto insurance app, the user’s profile should include all information about a particular client and his car. Also, you need to allow editing of the profile and view the last actions taken by the user.

-

Info about vehicles

It is pretty evident that before buying insurance, the user must provide some data about their car. Therefore, a typical workflow asks them to fill in some information about their car: year, make and model.

Dribbble shot by Lay

-

Quick documents access and submission

Carrying a pile of documents with you is old-fashioned. Instead, allow the user to download and access all relevant electronic documents with a single touch. Ensure they are securely stored on your smartphone and not accessible to third parties.

-

Policy review

Allow the user to view the terms of their active policy or show it for review if needed. Some apps also have a button to print the document, save it as a PDF, or email it.

-

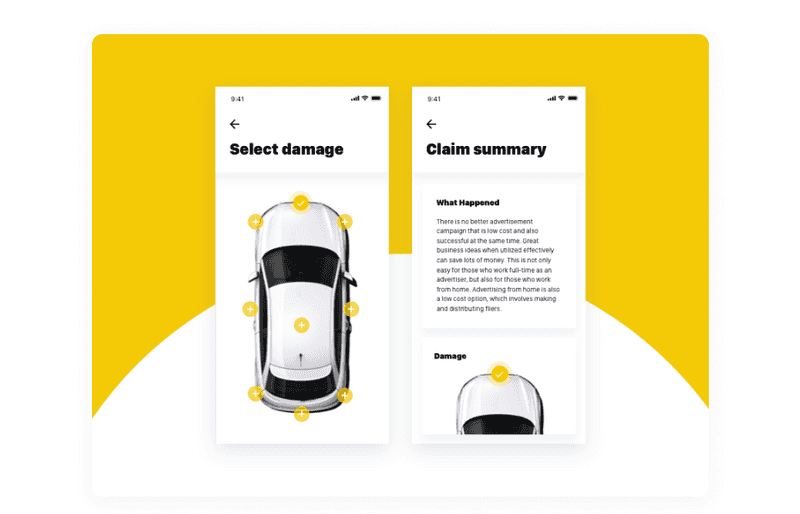

Claim filling

It is the primary function for customers who usually use the auto insurance app. For example, in a car accident, the user needs to enter all the necessary information quickly and upload photos for damage assessment.

-

Claim dashboard

Let the user see all the claims they made and at what stage of processing they are.

Dribbble shot by Purrweb UI/UX Studio

-

Accident help

When it comes to cars and driving, anything can happen, and in the event of an accident, the user will never have too much help. Therefore, consider getting urgent advice and making an emergency call from the app.

-

Camera access

Add a built-in camera function to your car insurance app so that the user can use it in case of emergency (car accident, robbery, etc.) for quick evidence collection or consultation.

-

Payment gateway

Users should be able to make any insurance-related payments directly from the app. Let them choose their preferred payment methods, enter payment details, and set up auto payments for policy renewals.

-

Filters

It is already known that drivers like to use inexpensive insurance policies. However, some drivers may have special needs. According to their needs, an agency needs to provide the most appropriate applications for its users.

Dribbble shot by Dylan Arendse

-

Search

A car insurance app should have a search feature that allows users to search for the specific policy that is right for them. Filters can also be added to this feature to make it easier to find a particular policy.

This search button will be most beneficial when an insurance company provides many options.

-

User support

The auto insurance application’s helpdesk should be multilingual, easy to interact with, and available 24/7. Alternatively, it could be a chatbot.

-

Feedback

Your auto insurance app can be infinitely good, as can your terms and conditions, but there can always be dissatisfied users. Or there may be some kind of error in the application. Therefore, it is essential to allow users to give feedback quickly. Furthermore, it will be helpful for your business because you can become better and provide better customer service based on feedback.

-

Push notifications

Push notifications and reminders will help your app connect with the customer and improve communication for service and marketing purposes. For example, notifications will remind users of policy termination and inform them of discounts and changes to the terms or status of a claim.

Also, through notifications, you can notify your users about new changes within the application. Integrating CRM with notifications by the system and various services is an important part.

These features will make your car insurance app great. But how to make it outstanding? Keep on reading to find out.

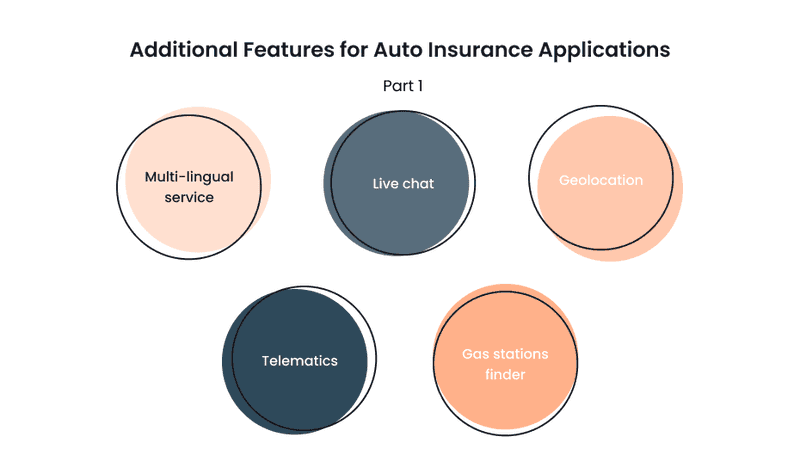

Additional Features for Auto Insurance Applications

Other features can make your application more unique and user-friendly. Yet, these features can more likely attract your clients to download your app and attract new users. Let’s look at some examples:

-

Multi-lingual service

A multi-lingual service will help you capture a wider audience of users for your insurance business.

-

Live chat

Your insurance operators should constantly be in touch with customers to answer possible questions regarding claims and policies.

-

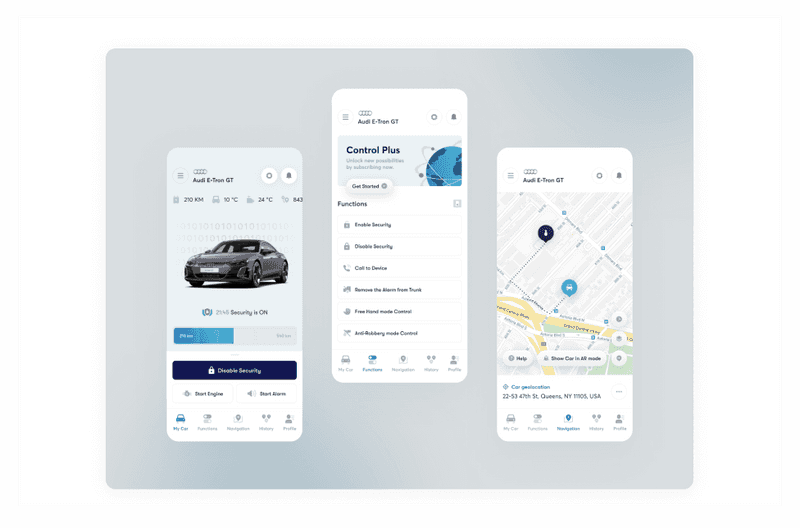

Geolocation

This feature makes it easier for your customers to find your office and helps you track your customers’ movements in the auto insurance app. If people are in another country, you can even direct them accordingly to find the right institution.

Dribbble shot by Toglas Studio

-

Telematics

It is a great feature to add to your auto insurance app. It uses artificial intelligence, gyroscope data, accelerometers, and GPS on a smartphone. All of this data is used to measure the driving skills of drivers.

The driver needs to permit to track these indicators for almost two weeks. During this time, all data is collected and analyzed, and as a result, the insurance company can offer the most profitable and suitable policy.

-

Gas stations finder

It is not precisely true for auto insurance, but the user will use the application more often if you add such a function. Offer users assistance in finding the most profitable gas station for them.

-

Route planner

It is another helpful feature. It is not directly related to insurance issues, but your customers will like it. They will have an excellent opportunity to plan and build their most safe and optimal route in advance, which means they can become active users of your car insurance app.

-

SOS button

Users should be able to get extra assistance in the event of an accident and other emergency traffic situations.

-

Insurance renewal

Give your users the ability to renew their insurance with one click.

-

Insurance registration for the others

Another great thing to think about is taking out insurance for other people. For example, users can insure their relatives’ cars, which is helpful. They don’t have to take extra steps or ask relatives to register separately to get insurance. Also, it is beneficial to allow managing these insurances.

-

Gamification

Customers perceive insurance as a complex product that involves a tedious buying process. But let this process be a little bit easier. A good example is the British insurance company Aviva gamified saving on car insurance. They created an app, Drive, to film their driving and earn a score. If the user gets a certain number of points, they save on their insurance.

The above features are optional, making your auto insurance app stand out and interesting to users.

Challenges you May Face While Creating the Best Car Insurance App

If you want to develop a progressive car insurance app, you need to know about challenges that may occur on your way while making it. If you know these beforehand, you will be ready to solute them.

-

Attracting new and existing customers to the app

Making your existing customers download your car insurance app may be challenging. They already have insurance coverage in your company, so why do they need to download an app? To resolve it, think of what features may lure them. If you make it, then there won’t be such a deal to bait new users to your auto insurance app.

-

Difficulty in claims processing

With a large influx of customers, it can become challenging to manually manage claims and insurance policies. But there is a solution. Artificial intelligence (AI) and machine learning (ML) technologies help speed up and improve claims processing and reduce manual processes and human error problems.

-

Insurance fraud

AI and cryptographic technologies can solve this problem. They help to identify suspicious and fraudulent activity faster and reduce the risk of false diagnoses of damage to drivers and vehicles, as well as employee fraud.

-

CRM integration

It may be challenging to integrate the CRM with your app from the tech side. But it is vital because when your customer downloads the app, they want to see their information there. They don’t want to fill it in again. But it doesn’t mean that it is impossible to integrate your CRM system.

-

Big data processing

Your car insurance app may start to work poorly due to a large amount of processed information. Cloud storage improves data security and reliability.

Dribbble shot by Aerolab

Final Words

Keep up with the leading companies in the market, creating an app for car insurance! It is an intelligent move to please customers who value convenience. Especially if we consider the complete digitization of business in our time. Let your customers have instant 24/7 access to your services in their pocket.

We’ve covered the basic steps to building an auto insurance app, the essential features you need to have in an app, and the challenges you might face along the way to building a progressive car insurance app. So you are fully armed before this task.

The Axicube team can create a customized go-to-market solution based on your company’s needs. We have extensive experience working with startups and companies from various industries. Let us help you improve your business’s efficiency and profitability with an innovative car insurance app.