Over the past few years, banking is digitizing and developing in all aspects. Traditional banking steps away, so it is not a surprise that user-friendly mobile banking apps are booming throughout the land. A bright example is Revolut - a UK fintech company that offers an open banking system, a prepaid debit card, a cryptocurrency wallet, and many other features. Referring to statistics, there is 169% of Revolut users growth in 2019.

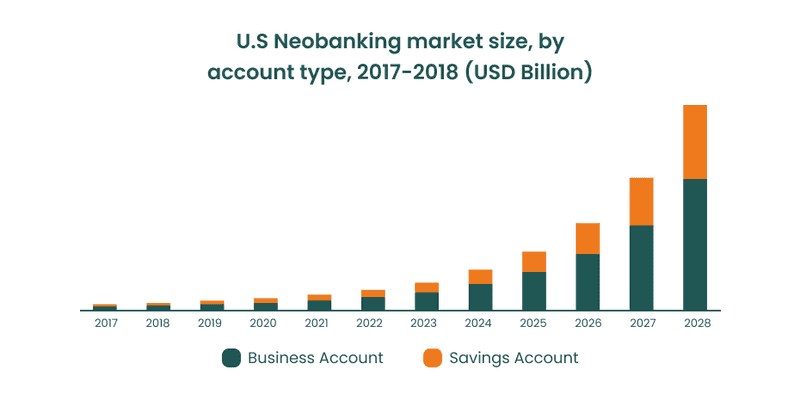

Yet, there are many good challengers, and one of them is N26 - a European fintech company that suggests smart, flexible banking in an app. According to research by Forbes and Statista, this neobank was selected as the best mobile bank in 2021. That is impressive, isn’t it? Such a thing as neobank is extremely growing. Citing to GrandViewResearch, the global neobank market was valued at $35 billion in 2020 and it is expected to grasp $722 billion by 2028. The market is estimated to have a growth rate of 47%.

There are many names used to describe such apps like Revoult and N26: neobank, online banking,fintech app, mobile banking, internet banking. It sounds quite similar, but what is the difference and how to design such apps?

What is online banking in essence?

Although these terms are sometimes used interconvertible, digital banks are often dependent on traditional banks. Neobanks are completely digital and independent. They are mobile only banks. The fact that neobanks are not associated with any traditional banks may raise concerns about lack of personalization but they can use artificial intelligence to keep track of your information and improve your app experience.

What are the benefits of mobile banking vs traditional banks?

Both of these products suggest some features that set them apart from traditional banks:

-

Lower costs

This is achieved by avoiding costs for operating bank branches. Being online, neobanks are not subject to duties. But mobile banking can still offer minimal fees.

-

Better app experience

Digital and neo banks spend a lot of time and resources to improve their online experience. Because of that, they can develop many useful and innovative features in their apps. Neobanks are user-friendly and aimed to develop an easy-to-use system. They are also well designed to meet the complex needs of the clients.

-

Expense tracking

Neobanks can use artificial intelligence to track your expenditure behavior and even send you notifications when you are on track to run out of money. Mobile bankings keep track of expenses by category, so you can get a complete statement of expenses. And that so you do not need to enter expenses in the app for expense tracking: the banking application itself categorizes everything.

-

Timesaving

Neobanks use new strategies to speed up some processes that can take a lot of time if you do it using a traditional bank. Yet, to become a user of mobile banking, you just need to download the app. Whereas in a regular bank, you need to spend several hours of time.

-

Convenience and functionality

The user can check account balances, find ATM locations, transfer funds, and even deposit checks by only opening an app on their smartphone. All processes go faster because clients don’t need to sign lots of documents.

What are the disadvantages of neobanks?

-

Compatibility concerns

Not every app is suitable for a certain model of smartphone. Yet, your device may not support a platform for which the mobile-only bank app is designed. Still, you need a stable internet connection to avoid lags.

-

Security issues

Mobile apps usually become objects for hackers. So you need to take attention and spend sources for providing security of your IT infrastructure.

-

Less trust

Neobanks need not only to gain trust but also to prove that they are better in order to take a client away from traditional banks.

-

Limited services

Mobile banking app allows you to do a lot of operations, but there are still some options that you can only make if you visit the branch. For example, if you want to withdraw a large amount of money from your card, you still need a bank office.

-

Higher customer acquisition cost

Traditional banks already have their own loyal customer base. And mobile-only banks need to look for their own audience, which can increase CAC.

Mobile banking has its advantages and disadvantages and before building your own product, you should consider both of these. If you study this issue thoroughly, you will be able to create a great mobile banking app. Let’s discuss the benefits of creating a neobank.

Why creating your mobile banking might be beneficial to you

First of all, creating your mobile banking is about the prevention of expenditure of financial resources. You can cut down on operating costs and the number of employees while improving customer service. Although, you’ll still need to provide online support for your customers.

There are other advantages of creating your mobile banking app:

-

Simplifying the workflow

Digital services give the ability to organize accounting without tons of papers. Referring to The Paperless Project, annual filing cabinet maintenance costs $1,500. One more advantage is that you can reduce the burden on the environment with this benefit. It can attract users who care about ecology.

-

Better information security level

Present-day IT infrastructure is well protected from data leakage, theft, and even server-side threats which are 54% of all vulnerabilities. Your information and your customers’ information will be well protected, so it may attract people to you. Safety is important.

-

Improved marketing

People use ad blockers, so businesses look for new ways of promoting their products. In your mobile banking, you can just send a push notification to tell users about your new features. Because of this benefit, you can be closer to your clients.

-

Information is power

Every user action can be recorded and applied to analyze behavioral patterns to develop new strategies and provide needed features.

If you are still in doubt about the idea of creating your own mobile banking, below are the success stories of internet bankings that have already become popular.

The Best Mobile Banking App: Success Stories of Revolut and N26

If we still haven’t convinced you that starting your neobank is a good idea, here are some success stories from big online bankings.

The story of Revolut shows how important it is to founders of startups to clarify the needs of the audience and to give the right solution for it. Revolut has become a helpful tool that solved the problem of high commissions in foreign exchange transactions. They have provided a multi-currency card that allows paying abroad in needed currency without paying commission for conversion.

So, it attracted users and for now, Revolut has 10 million current users and 12 thousand average daily signups. They have 380% of daily active customers growth in 2019 and 2 thousand people working for them.

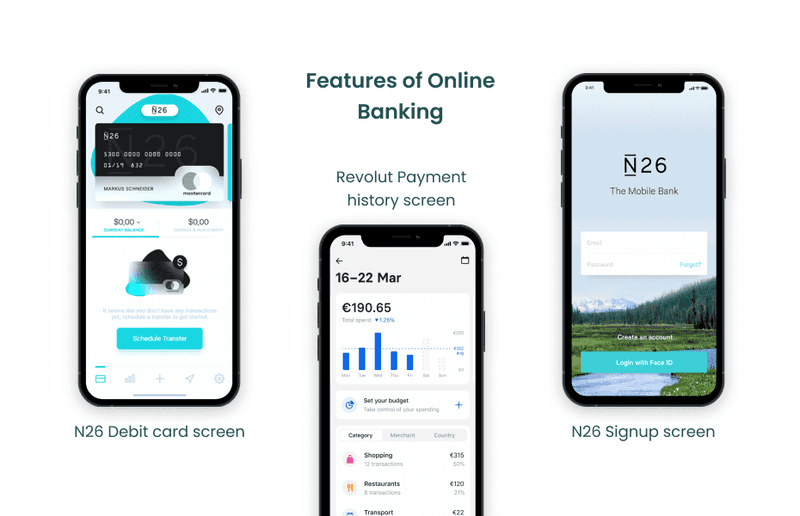

N26’s story began back in 2013. They wanted to move people away from the old system which was stressful for many. N26’s founders understood that people need a clear online system that can be flexible and user-oriented. Through research, they found out that their mobile banking should be more than just a convenient way to make a payment. They need an emotional link. N26 built an experience that empowers people to reach their financial goals and lets them control their spendings. In 2020, they had 2 million signups.

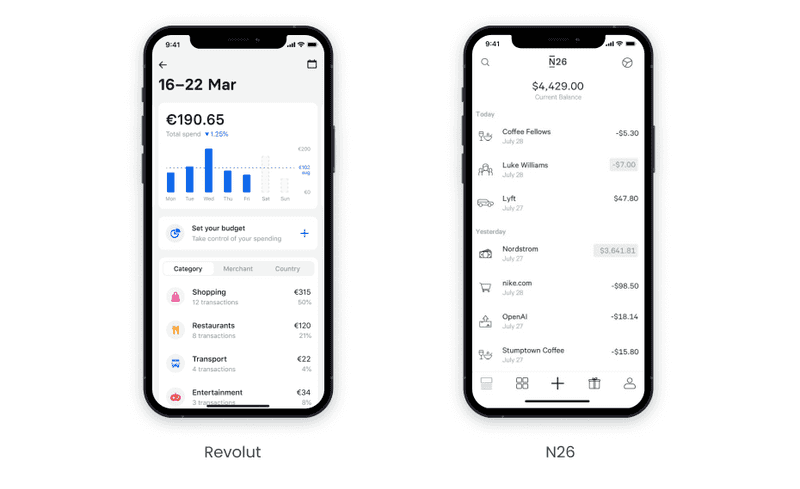

But what are the features of these mobile bankings? What makes them outstanding?

Must-have Features of Online Banking

Revolut and N26 provide a set of features that makes them good competitors over traditional banks.

-

Quick signup

Customers don’t need to submit any forms for registering as the traditional bank requires. The process is simple because they have minimized the information users need to fill in.

-

Onboarding

Quick and clear onboarding lets users get acquainted with the app. After this process, the user has a clear understanding of all features and possibilities of your mobile banking app.

-

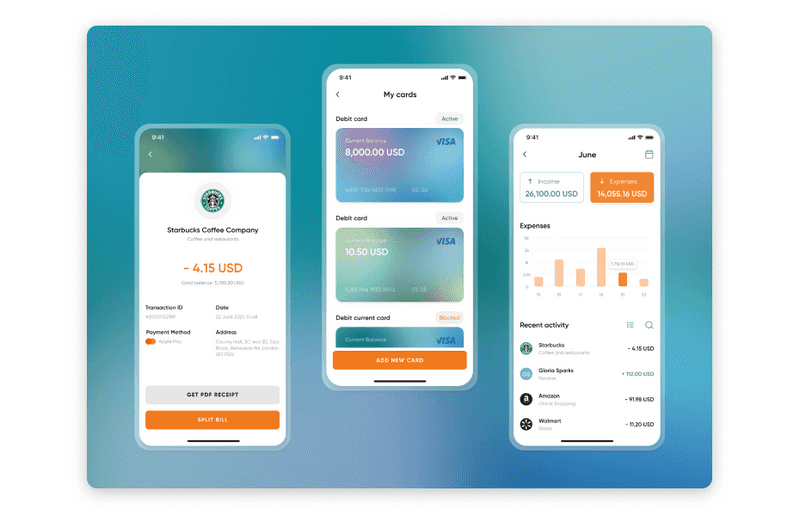

Payment history

The users can see where their money goes and control their spending habits if it is necessary. For example, Revolut divides spendings into few categories so the customer can see statistics of the squander. It is possible to set a spending budget to discipline oneself.

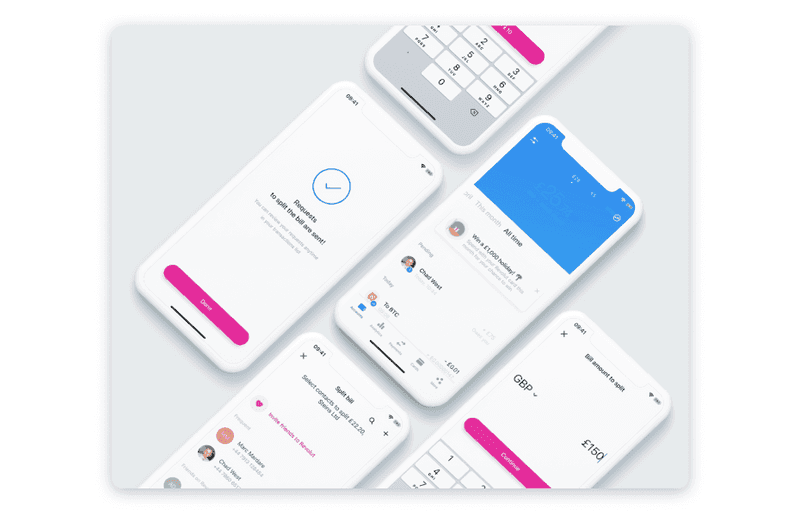

Dribbble shot by Axicube

-

Push Notifications

It lets users inform users about any actions within their account. Yet, it allows us to let users know about new features provided in the app.

-

24/7 Support

A neobank hasn’t limited banking hours, so support should also be unlimited. It is necessary to run processes smoothly.

-

Personal debit card

That can give the users an ATM withdrawal feature which is important in the process of opting for you as the only bank they want to keep an account in. You can add an option to connect cards to Apple or Google Pay so users could pay using their phones.

-

Location of ATM

This can display both a list and a map view of ATMs that are near to the current user’s location.

-

Personalization

It can be personal offers or cards. If your main audience is the elderly, try to make your app simple to use. Ensure that your mobile banking app is personalized and based on the user.

-

Money transfer

With online banking you can move your money as easily as just a few taps.

Dribbble shot by Axicube

Now we define what features are necessary to improve users’ experience. But there is a list of extra features that could make your mobile banking app outstanding. Because it is not enough to be like everyone else, you need to be better!

Extra Features

Ron Secrist, head of online and mobile banking at Capital One claims: “Offering innovations that customers are looking for—not just innovation for innovation’s sake.”

We have put together a small list of extra features that can be useful for your future clients and may attract more users to the mobile banking app.

-

Shake to pay

This feature is provided by the Monobank app. Its essence lies in that if you shake your smartphone with the Monobank app open, the search for nearby devices is turned on. If someone nearby does the same, then the applications will find each other and activate the P2P transfer function between the two cards.

-

Referral program

You can provide different rewards to increase user’s interaction with your app. For example, there is a robust “Refer a Friend” in the N26 app. This allows users to invite friends via mobile app. When a new user logins into one’s account and makes one transaction worth €15, the referring user will receive a reward of €15.

-

Split bill

In Revolut, if you want to split bills with your friends, you can just tap a button and choose anyone from your phone contacts.

-

Voice payments

This new feature is now available in the Royal Bank of Canada and Barclays’ mobile banking apps. The clients of these banks can pay their bills using only voice by asking Siri. A 2017 BI Intelligence study found out that the number of voice payment users will quadruple over the next five years, reaching 31% of the US adult population - or 81 million consumers - by 2022.

The owners of mobile banking apps often think of what features they might require. But nowadays, user orientation is the main thing in the banking industry. Your main goal is to think about how to help clients to manage their money more effectively.

What is about online banking design?

Friendly UI/UX is an important aspect of the modern mobile banking app. This can add clarity to your app and reduce cognitive load. Modern banking app designs usually consist of prestigious-looking graphics and minimalistic colors. A good example of a mobile banking app using trendy UI design is Revolut.

The color scheme of this app consists of purple, pink, white, and blue branded colors which help to add clarity and contrast to each page. Revolut uses different color shades to highlight different accounts and options. It also uses different shades of gray for a focal point to important text and explanatory paragraphs.Another great example of modern banking app design is N26. They improved readability by converting a long list of options to cards. So, users see cards with text and symbols instead of a vertical list of text links. The users can group these cards into a set of panels or a grid. This smart solution in the N26 app design makes each option look more visible and helps the user to find a needed option faster. As a result, the N26 design provides readable options and a friendly UI.

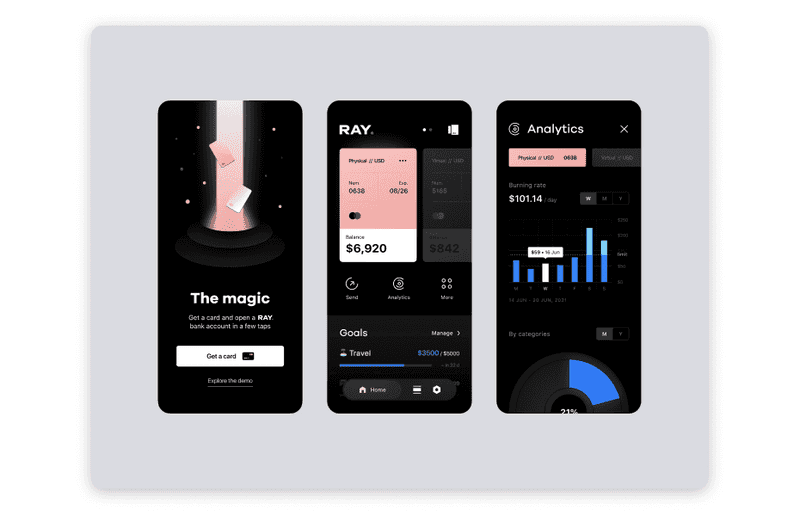

Dribbble shot by Alexander Plyuto

Creating a mobile banking app design is quite difficult. The users should not only find the app useful but enjoy it. Read below about the process of creating a great neobank app design!

The Process of Creating a Digital Bank App

Now we can go directly to working on the UI/UX design of the mobile banking app. This process can be divided into several steps.

Define your USP

Unique Selling Proposition or USP is like a special thing about the product you want to create, which will make it exceptional from other brands on the market. Defining it can help to promote your product. Yet, you can analyze your competitors to find out what user needs are not closed and what problems do users of other apps face. After you have completely decided on the concept of your idea, you can move on to the next stage of mobile bank development.

Research and define personas

Banking solutions cover a wide segment of the audience. There could be few personas like business owners, office workers, students, housewives, etc. Consider what features they need. Think of situations when they may contact customer support and identify the most viable responses to their requests. At this step, you can interview users to check if your guesses are correct. After these steps, you will know what features are needed in your mobile banking app.

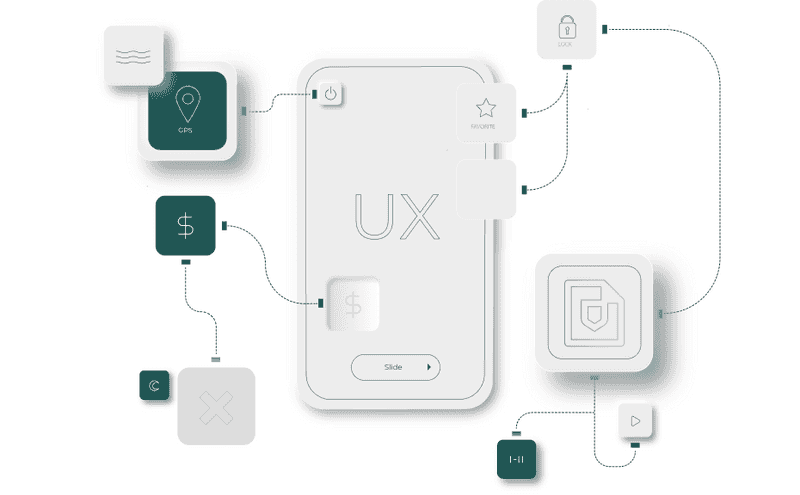

Form User Flow and Wireframes

User Flow illustrates the order of actions that a user takes to realize the goal. This is a fundament of an interface that consists of separate screens. A user-friendly interface begins precisely with the elaboration of the structure.

You should think about how to optimize user flows to three actions as maximum. The fewer steps a user takes towards the goal, the better. When thinking of this task, try to use Hick’s Law. It says that the time it takes to make a decision increases logarithmically to the number and complexity of the options that are available. Therefore, the fewer steps and the simpler each of them, the better. Simple mobile banking works great with every audience segment.Then, the next step is to create wireframes. This will help to visualize the structure of future pages. Consider which features will be visible immediately and which you can hide in the drop-down menu.While wireframes are mostly about the layout, prototypes are more about interaction experience. A prototype is like a preview of your future app. It is important to test it with real users to eliminate errors.After these steps, we can step to concepts and UI/UX design, which may increase conversion and attract users. When creating UI, you sometimes have to go to the previous stages, since the design is an iterative process.

Principles of Making UX Design for Banking App

There are a few bases in creating a good user experience:

-

Be accessible

Remember, that there are people with visual, motor, and hearing impairments. Banking mobile app design should take into account all groups of people. The app should be comfortable for everyone.

-

As simple as possible

Don’t create too complicated interfaces so as not to confuse users.

-

Don’t experiment too much

Use the best practices and you won’t be mistaken. Study the best solutions to understand why they work. But don’t forget to adjust them to trends. So that, your banking mobile app design won’t become outdated too quickly. If you know how to improve it even more, then do it.

-

Less text

Don’t force your users to read tons of text. Try to use more graphics instead. Try to give only the necessary and most important information. People appreciate it if we don’t waste their time.

-

Don’t forget to group everything

Group information into blocks so it would be easier for the user to understand it. Divide information into logical blocks so that similar and interrelated functions are side by side. Simplify information architecture and it will be easier to use your app.

-

Show the main parts

Try to highlight important elements so they will be visible. This way we will simplify decision-making and improve the usability of the product.

-

The less is more

Don’t put too many functional elements on one screen, because it will be difficult for the user to keep it in mind. Remember Hick’s law - do not complicate the choice. Make simple mobile banking and you won’t be mistaken.

-

Personal settings

Consider the possibility to adapt the interface for different users. The clients want to feel an individual approach, so give it to them through personalization.

-

Context is a matter

Think about when and how your users use your app: on walks, on coffee breaks, etc. How could it affect their behavior? Everything of that may have affection on the user scenario and final product.

After we have cleared what is crucial to make good UX, we can go to the next part of the process of creating a digital bank app.

Dribbble shot by Nela Rosdiana

How to Make a Successful UI Design for Banking App?

A strong UI leads in making it clear, easy to navigate, and good-looking at the same time. People like to look at beautiful things. So, no matter how good your UX is, if you create a good UI people will stay with you. A task of UI design is to reduce cognitive load and let users get things done easily. Now, we can go to things which you need to pay attention to if you want to make a successful online banking design.

Colors

This plays a big role in banking app design. If you choose it right, the color will improve your design and help to reflect the brand voice. Your color scheme should have a good contrast ratio which will increase the readability and whole understanding of the interface. Yet, don’t use only colors without graphic elements and explanations in your mobile banking app UI design.

For example, there are color-blind people, which are not able to fully discern red, green, or blue light. It is difficult to distinguish between red and green to the ones who have red-green color blindness. According to studies, 1 in every 12 men (and 1 in every 200 women) are color blind. So, it would be great if you would keep this in mind when choosing colors for your future banking app design. Choose a few bright or even playful colors and you won’t be mistaken.

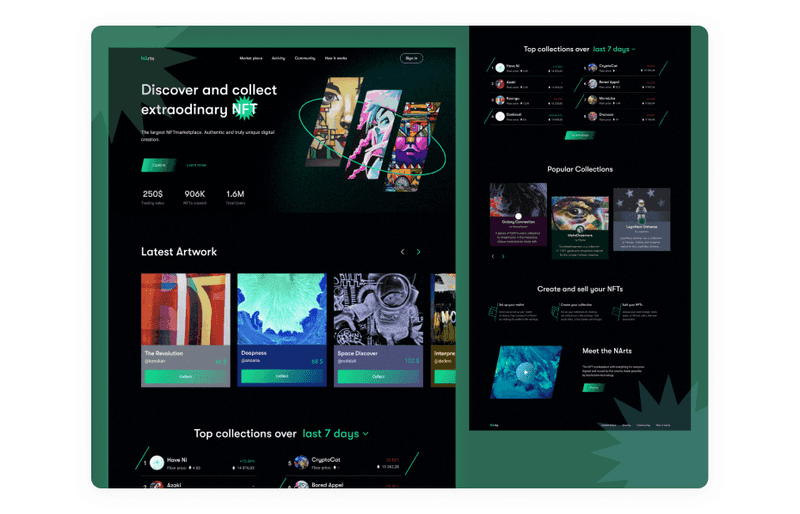

Graphic elements

Consider using flat design elements. These were trendy for a long time and still are popular because of efficiency. Mobile banking apps are usually data-heavy and elements like these can add more clarity to the look. If you choose graphic elements guided by this, this will be the best mobile banking design decision.

Dribbble shot by Shakuro

Minimalism

Use simple layouts and avoid overly exaggerated design elements to not to distract user’s attention from their main goal in your mobile banking app. Good design should not distract but focus on the user’s needs.

Illustrations and tone of voice

This may help you to personalize your app and speak the user’s language. Illustrations can also help with brand recognition and associations. For example, it works great when you add it to onboarding. Illustrations also can help you to avoid using too much text in your online banking design.

Animations and micro-interactions

Good animations could help users to focus on the main elements. Moreover, it can increase usability.

A clear mobile banking app UI design reduces overloaded screens and makes app usage enjoyable. This will attract new users, and they will remain due to good UX and thoughtful functionality which will resolve user’s problems.

How our CDO Deliver a NeoBank

Our CDO Eugene Tretyak had successfully worked with neobanking. This project was received from Concord Bank. The project team gave a brand book, idea, analytics, and user flow. The task was to make the catching online banking design that will be competitive. It was based on our understanding of the audience, the wishes of the client, and the services that the bank offers. Some features were updated within the application itself. For successful work on UX and UI, it is necessary to be on the same page as the marketing department. It is important to work closely on the project and not to compete with each other. There can be good ideas from designers and from marketers and both of them will make a great product with common effort.

There were also challenges in it. For example, there was an offer to let users name themselves as they want to. But it doesn’t work for a product like this, because of financial monitoring and different documents that may be required. One more challenge was to create a personalized dashboard for the users. We decided to create a widget system, which could cover all needs of demanding customers by customizing the interface.

We interviewed users and conducted usability testing for prioritizing features, planning our capacity and testing our hypothesis. To make it, we cooperated with business analysts and achieved good results.

Overall, it was interesting to work on different mobile banking app parts, like Payment of utility services, or Deposits. As a result, we made a cool application that thousands of clients are successfully using and were able to help attract new customers to the bank and increase the number of online users. It gave us a good experience, especially in mobile banking app UI design.

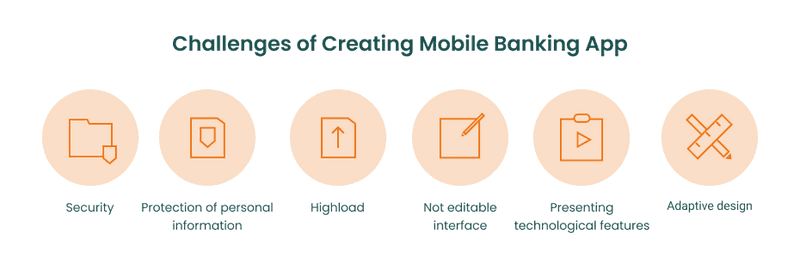

Challenges of Creating Mobile Banking App

Making a great mobile banking app is a difficult task with tonnes of challenges. There are a few that may appear on your way:

-

Security

This is the baseline of every bank, especially neobank. That is why it is necessary to think through all the moments, which may require a good development team. But remember, it is not enough just to be secure, it is necessary to convince users of this.

-

Protection of personal information

This may be a top concern in creating your mobile banking app. It is not enough to protect your own data, you need to keep the user’s information safe. You can provide multifactor authentication and set an in-app timer for user sessions.

-

Highload

A mobile banking app may deal with lots of requests every day. You need to be experienced to create an app which is able to withstand such a load and process information.

-

Not editable Interface

New features will probably appear in your mobile banking app, which can cause certain difficulties in implementing it. You should think of it when planning navigation, so you will be able to add new functions which will suit the product organically.

-

Presenting technological features

When a bank decides to present a new feature inspired by new technological trends, a UX designer faces the problem of how to present it to users. In this situation, it is important to clearly understand every group of the target audience and how, when, and which information they need to know

-

Adaptive design

Each platform has its own design guidelines and trends. Something may work for Android, but be irrelevant for iOS. To make the user’s experience better, you should adapt or even create the UX from scratch for every platform.

However, on the other hand, these are not challenges, but opportunities to improve the system. Try to extract the benefits out of this. If you will be able to do this, your app will become exceptional.

Conclusion

An idea to build a fintech app like Revolut or N26 will absolutely have a big chance of growth in today’s world. Since, we have already discussed in detail the features, functionality, design, and many other details of what it takes to create a mobile banking app like Revolut. Creating an internet banking app needs providing a competent approach and a professional team for creating a useful and secure app. But still, don’t forget to take your attention to the next points:

- Understand and define your audience;

- Present unique USP (differentiating from your competitors);

- Focus on the UX for main features;

- Eye-catching UI for attracting users;

- Secure IT infrastructure.

Designing a good mobile banking app is a difficult task. Now, if you want to stand out, you should offer a catching banking app design. To make it, you need to collaborate with a competent design team. How well it coincided that we have experience in creating designs for different types of business applications. Axicube team creates exceptional designs. We already had expertise in working with startups and products.